Trade war will intensify the global growth slowdown this year and next as supply chains are disrupted, consumer and business confidence are dragged and inflation jumps at least temporarily. Mild US recession is now more likely. China to US container loads have already dropped precipitously. Various products will be in short supply, at least temporarily. Retail, logistics and transport jobs are most exposed.

US consumption will be weighed by the post-tariff jump in goods prices. The increase in production costs will weigh on profit margins and the demand for workers. Demand for exported items to the US will suffer. China’s retaliatory tariffs will reduce US export competitiveness. Softer China activity will weigh on Chinese import demand.

Many countries are rushing to make deals with the US administration to avoid potentially high tariffs. Mexico could be well positioned to gain from its cost competitiveness, close proximity to the US and more benign geopolitical relationship than China. The European Union however, given its greater scale, may take on a more combative approach with the US so may be lumped with heftier trade costs. Exporting nations like Germany could be incentivised to increase fiscal spending to help expand domestic demand to offset lost competitiveness with the US and China.

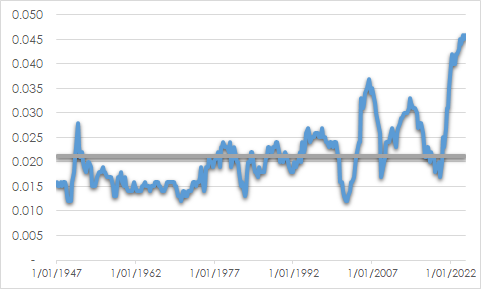

US profit margins are near record levels so there is some room to absorb tariff costs. Softening consumer conditions will make it more difficult to pass costs on. Large businesses with diversified supply chains and stronger ability to negotiate over price and volume will be better placed than smaller firms to manage the challenges.

CHART 1: PROFIT PER UNIT OF REAL GROSS VALUE ADDED OF NONFINANCIAL CORPORATE BUSINESS (USD)

Source: U.S. Bureau of Economic Analysis, AssureInvest

Policy uncertainty dragging consumption and investment plans

US policy uncertainty is now as high as it was during the pandemic. US consumer spending has remained reasonably solid helped by household balance sheets in reasonable shape. However, there is a mismatch with sentiment that could prompt a rise in savings rates while heightened uncertainties persist. University of Michigan Consumer Sentiment plummeted to as low as 57 in March 2025, well into the bottom quartile of survey results since the 1970s.

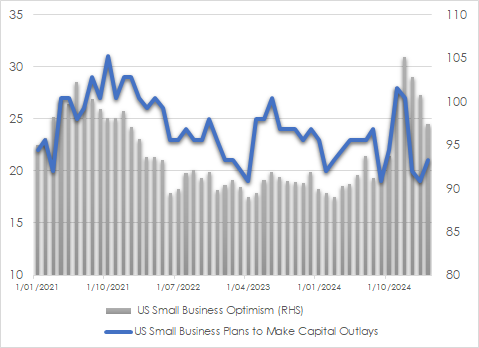

Higher input prices and uncertainty are already causing some US businesses to pull back on expansion plans. Surveys such as from National Federation of Independent Business (NFIB) indicate a sharp downturn in capital expenditure plans by small businesses in the US. China’s manufacturing purchase managers index has dipped back below 50 indicating decline. China’s reliance on exports is reducing however as it builds its consumer economy, though this has recently been weak due to the depressed property sector.

CHART 2: US SMALL BUSINESS OPTIMISM

Source: NFIB

Other US policy changes are more stimulatory but are unlikely to compensate for the tariff growth drag. Deregulation in energy, finance and consumer protections should lift growth, reduce business costs and free up funds for productivity-enhancing capital investment. Longer term growth may be enhanced and inflation lowered, but at the expense of greater inequality and reduced systemic safety. Congress is working on legislation to extend the income tax cuts within the 2017 Tax Cuts and Jobs Act (TCJA) due to expire this year. Other personal tax cuts like exempting social security benefits, overtime and tax on tips should provide a modest one-off boost to household income but this impact is unlikely before 2026.

Manufacturing jobs unlikely to return to the US

The US and other advanced nations have benefited greatly from globalisation in recent decades but there have been job losses as manufacturing is transferred elsewhere. Artificial intelligence also offers wonderful opportunities for wealth creation but there will be roles lost, particularly amongst white-collar work, to be reckoned with.

Tariffs hinder total trade, necessitate significant reworking of highly integrated global goods sectors and weigh on job creation. Even if certain sectors gain from changed trade rules, other sectors are damaged.

It is questionable whether a significant number of manufacturing jobs will return to the US given comparative advantages in Asia and elsewhere such as large cost-competitive labour forces, efficient supply chains and cross-border production networks, economies of scale and high levels of automation.

US manufactured output is unlikely to rise substantially in the short term because there is not sufficient latent production capacity or available pool of appropriately skilled workers. Construction of new factories typically takes several years. Consumers preference for cheaper and higher quality products will entice the purchase of foreign-made goods regardless of any tariffs that are in place.

Central banks have room to move

Central banks have firepower to support economies but rates are blunt instruments that take time to impact. Softer commodity prices and jobs growth should allow inflation to moderate more quickly than might have been expected a few months ago. Cash rate cuts of 100 basis points or more are possible in the US, Europe and Australia by year end.

The US Federal Reserve’s job is complicated by the need to balance the upward push to inflation with the downside to growth. It will be keen to see inflation expectations declining toward target levels before recommencing the cutting cycle. This is unlikely before June or July. European inflation is dropping more obviously, helped by lower imported inflation due the stronger currency and likely lift in redirected cheaper Chinese goods.

Investment strategy

Higher than usual discrepancies between bull and bear cases for economies and corporate profits encourage caution. Consensus estimates are taking time to appropriately reflect the implications of new trade settings. Reasonably full valuations in both equities and fixed interest urge the steady building of cash balances as portfolio dividends roll in.

Earnings recovery from next year should be helped by greater policy certainty and lower interest rates. More sharp risk asset selloffs can be expected in the meantime. Good companies adjust and several will find vast opportunities to extend market power by leveraging scale advantages, strong brands, technological expertise, and ability to retain and expand client relationships.

Our portfolios are structured to ride out the challenges relatively well through our diversified array of predominantly high-quality, well priced instruments with additional cash balances. Global equity markets are around fairly valued so should produce reasonable returns in time. We are underweight US equities where valuations remain stretched and diversification benefits are reduced by the high concentration in high quality mega-capitalisation technology firms. Our overweight to Europe reflects that region’s more favourable valuation and likelihood of earnings gains through a positive fiscal pulse and more rapid monetary easing than other regions. We recently added weight to international value-style stocks set to benefit as a cyclical recovery eventually takes shape. Our fixed income portfolio duration is slightly extended to benefit from the higher yields on offer and the likely market flight to safety during volatile times.

FREE Special Report: How to Jump ahead of competitors and add more value for clients

Learn how you can boost profits while enhancing customer outcomes.