Global economic activity has held up remarkably well in 2023. Tighter monetary policy has been offset by improving supply chain efficiency as conditions normalise from pandemic and Ukraine war shocks. Interest-rate sensitive spending has been hampered by the substantial lift in interest rates since mid-2022 but there are early signs of bottoming in some areas like housing where undersupply supports price appreciation.

Consumption this year has been propelled by excess savings, rising incomes, catch-up post-pandemic services demand and the recent deceleration in some living expenses. Household and business balance sheets are in relatively good shape given the extremely generous government support during the pandemic and the extraordinary monetary stimulus during 2021 and 2022 which allowed many to refinance at lower interest rates.

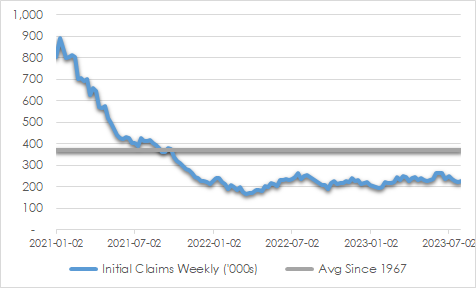

Jobs markets have been particularly strong. Initial jobless claims in the US have actually declined once more in recent weeks. Some 227,000 people filed claims in early August, down on the recent peak of 265,000 in mid-June and well below the average of 369,000 since 1967. Businesses do not want to reduce headcount because of the trouble they have experienced finding suitable staff in the last few years. US payrolls have grown by an average 240,000 per month in the last three months and unemployment has been merely 3.4-3.7% during that time.

CHART 1: US INITIAL CLAIMS FOR UNEMPLOYMENT BENEFITS

Source: St Louis Fed, AssureInvest

Government spending continues to encourage activity and contribute to inflationary forces. Pandemic crisis government stimulus has been reined in, but budget deficits remain commonplace. Policymakers are feeling pressured to direct support measures to offset higher prices for essential food and energy items.

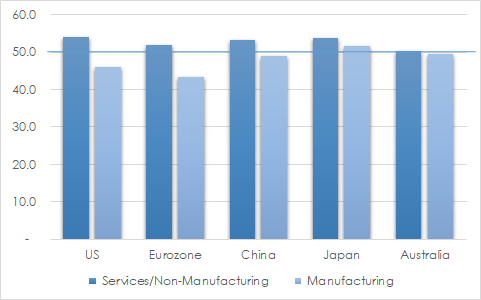

Momentum is starkly different between services and manufacturing sectors. Services expansion endures across the globe, assisting the technology-heavy US economy more than others. Manufacturing has been in decline since late last year which has been particularly challenging for industrial-led economies like Germany and China. Services purchase managers indices (PMIs) are above the mark of 50 indicating expansion in all key regions. In contrast, only Japan has manufacturing PMI above 50, assisted by automation to deal with the shortage of skilled labour and international efforts to take production back onshore.

CHART 2: GLOBAL PMIs

Source ISM, Bloomberg, Caixin, Judo Bank

Economic momentum is likely to fade as the year progresses as higher interest rates and stricter lending standards weigh even more. Enduring inflation challenges will likely encourage more tightening rounds which will further constrain credit availability. Several regions are likely to experience recession by early next year.

Pandemic savings are being run down over time, so consumption will track more closely household income levels and the ability to attain credit which will weaken as job creation slows in coming months. That said, a continued revival in housing would add to household wealth, adding to the capacity to spend and extending the period until the downturn commences.

The US Federal Reserve has acted more dramatically than many central banks. Slower growth should help unemployment rise and inflation fade by early next year. Rate cuts will follow. Other regions with more muted policy actions may carry higher rates for lengthier periods.

Application of artificial intelligence technologies appear to offer opportunities to lift productivity across several industries, but large-scale benefits will of course take time. Automation will no doubt threaten jobs across both lower and higher skilled occupations. However, sweeping displacement is less likely as automation typically alters work practices while creating new roles.

Inflation is declining but is likely to stay well above targeted levels for an extended period, thereby requiring a lengthy passage of tight monetary policy. Further rate hikes are likely in several regions.

In tune with the differences in demand across the two segments, inflation has declined for goods but increased for services due to tight labour markets and elevated rent and travel prices. Excess savings and pent-up demand following the pandemic are likely to extend the upswing in services demand for some time yet.

Several deflationary forces of recent decades are now less impactful. Efficiencies are reduced by the current shift to re-shoring and supply chain resiliency and away from outsourcing to lowest cost global suppliers.

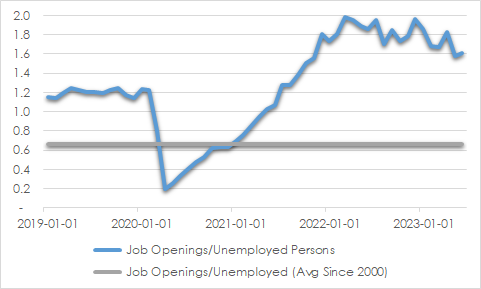

The US Federal Reserve will be concerned about average hourly earnings rising 4.2% which is well above pre-Covid levels while unemployment remains just 3.6%. The ongoing strength in labour demand shows it has more work to do. This challenge is being increased by the rise in the number of people involved in the workforce given the buoyant conditions. Workforce participation at 62.6% has increased mildly in the last two years. However, the prime age working group of 25–54-year-olds have entered employment in growing numbers. The 83.3% current rate is the highest since 2008. Job openings have declined in recent months but remain well above the number of unemployed people.

CHART 3: US JOB OPENINGS TO UNEMPLOYED

Source: St Louis Fed, AssureInvest

Monetary policy settings moving further into restrictive territory should eventually encourage a softening in inflation toward targeted levels as the weights on activity become increasingly burdensome. Rates could be lifted a further 25 basis points in both the US and Europe this year. There will probably be room for rate cuts in the US by the middle of next year and possibly also in Europe given soft underlying economic fundamentals.

Investment strategy

A more challenging environment for shares is likely in the next several months given the recent rise in investor confidence in the face of a decelerating corporate earnings profile. Downward pressure on discretionary consumption will intensify as higher rates and softening labour markets eat further into incomes. Margins will be crimped by softer demand and higher wages and other costs. Hoped-for big bang style stimulus to boost China demand does not appear to be emerging. US and European stocks look increasingly expensive though Japanese equities may have further to run especially if evidence continues to mount that the very lengthy deflationary period is over, giving way to constructive mild inflation.

As earnings disappoint overly optimistic expectations, opportunities may arise to add to uniquely-positioned businesses in discretionary spending and industrials sectors with temporary margin pressures. During challenging economic periods, structurally-growing, internally-funded enterprises of the type we typically favour are likely to fare better than most.

We are building cash levels which offers decent low risk return after recent rate rises. We are positioned to snap up bargains through our underweights to equities (mild) and fixed interest (more significant). Yields are unlikely to rally significantly given the peaking of inflation at relatively high levels while credit spreads appear fair rather than cheap.

Andrew Doherty. AssureInvest

This article is provided as general information only and should not be construed as personal financial advice. It does not take into account the reader’s objectives, financial situation or needs.

FREE Special Report: How to Jump ahead of competitors and add more value for clients

Learn how you can boost profits while enhancing customer outcomes.