International activity is slowing significantly and is likely to remain subdued in the next several years.

To quell demand, monetary policy is likely to be persistently tighter than might have been expected given strength in employment and services, which is less interest rate sensitive than goods demand. Recessions are not imminent given solid labour markets, but weaker earnings should prompt a rise in unemployment in the next year.

Some 285,000 new jobs have been created each month this year in the United States. This is more than will allow unemployment to rise from the low 3.4% current rate. A more considerable slowdown should be in evidence by the end of 2023.

China provides key positive impetus. Consumption is rebounding from Covid lockdowns while property and infrastructure post mild gains weighed by heavy debt burdens.

Bank troubles will exaggerate activity slowdowns. Credit flows are likely to be constrained by higher interest rates and the associated net interest margin squeeze from higher deposit and wholesale funding costs.

More smaller US bank failures appear likely. Regulation and supervision are likely to increase. To reduce vulnerability in the banking system, officials should encourage consolidation, larger capital buffers and greater customer diversity. Regulators should also ensure that banks are better prepared for rare but inevitable periods of sharply rising interest rates such as was seen in the last year.

Housing markets are in dramatic downturns, so sensitive to interest rates. Consumer spending is being weighed by higher mortgage payments and other cost of living pressures. Lower house prices, after the previous strong uplift, weigh on confidence through the “wealth effect”. The timing of the drag is slowed in countries like the US with a greater proportion of fixed versus variable rate loans. Even so, significant increases in delinquent loans are likely to be evidenced in coming months.

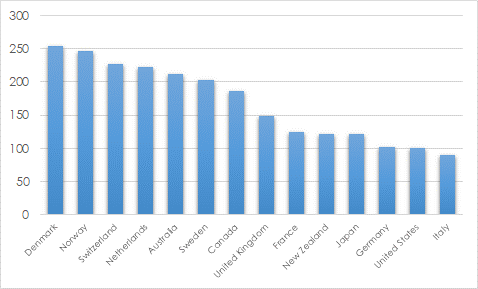

Many central banks are nearing the end of tightening cycles but pressure on consumption will remain until rates decrease once more. Central banks need to be more wary of downside risks in countries with higher household debt levels such as in Scandinavian nations, Australia and Canada. The Reserve Bank expects that, while most will have positive spare cashflows, by the end of 2023 some 15% of Australian households will have mortgage payments and essential living expenses exceeding household disposable income.

CHART 1: HOUSEHOLD DEBT % DISPOSABLE INCOME SELECTED COUNTRIES (2022 OR LATEST)

Source: OECD

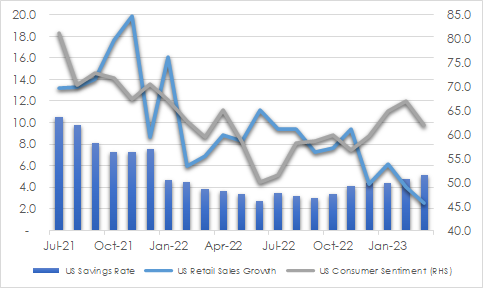

Reasonably healthy household balance sheets in advanced nations should help reduce the severity of impending economic downturns. Household savings jumped through generous government stimulus during pandemic lockdowns. Many households have funds remaining to deal with financial shocks, though much is concentrated among higher income groups. Strong consumer spending in the past year has been supported by the running down of savings balances. However, this is unlikely to be sustained given both a rise in caution and a fall in capacity. University of Michigan’s US consumer sentiment index at 63.5 in April 2023 was well below the average around 85 given the troubled outlook. Reflecting this negativity, US savings rates have lifted since mid-2022 after previously falling to more typical levels. Meanwhile, the recent rise in consumer borrowing indicates that less wealth consumers may be spending unsustainably and will need to curb this soon.

CHART 2: US CONSUMER WEAKENING

Source: St Louis Fed, AssureInvest

Inflation is moderating but remains uncomfortably high. Goods inflation is softening markedly as pandemic-related supply constraints and elevated consumer demand become more balanced. However, tight labour markets continue to propel wages costs, and strong services demand is allowing these to be passed through to prices.

US underlying inflation, stripping out volatile energy and food, at 4.9% is only modestly lower than the peak of 6.0% in September 2022. Aggressive US Federal Reserve rate rises in the last year are helping cool the overheated economy. Rates could be lifted a further 50 basis points in the next few months, taking US rates above 5.5%. Weaker demand should allow inflation to fall further.

The eventual easing by the US Federal Reserve is unlikely to be until inflation is close to the 2% target, even as a mild recession persists. This may be in the middle of next year. Investors hoping for rate cuts this year are likely to be disappointed. The Fed will be motivated to maintain higher rates to help restore the inflation-fighting credibility it lost after waiting too long to tighten policy despite evidence in 2021 of strongly rebounding post-pandemic activity, prices and risk-taking.

European underlying inflation is also stubbornly high at 5.7%. Policy rates are likely to be lifted in the next few months possibly by a further 50 basis points from the current 3.25%. Softer conditions should allow inflation to subside toward the 2% target through 2024, and policymakers should be given the opportunity to make first rate cuts late in the year.

The Reserve Bank of Australia has hesitated to raise rates given the volume of fixed rate mortgages rolling onto higher variable rates this year. At least one more 25 basis point increase is likely, but solid ongoing activity and sticky inflation reduce prospects for cuts for an extended period.

Investment strategy

Macroeconomic factors are likely to surprise markets. In equities, we are preparing for tighter lending conditions and higher cost of funds given heightened rates and troubles among smaller US banks. Monetary tightening may conclude soon, but rates pressure cannot be relieved until inflation returns to target levels which appears some time away yet. Profit margins should be constrained by softer volumes and stubborn costs.

Our focus is on attractively valued high-quality companies generating strong internal cashflows with less need for external financing. Heightened cost pressures necessitate concentration on those able to pass these on to customers through higher prices. Limited outright value available in markets and a global activity slowdown that may last years mean that sustainable dividend growth will be more prominent in returns.

In regional equities we are underweight the US which is stretched on valuation despite its higher weight to high-quality growth names. We are neutral Europe which is more cyclical but has better valuations. We are overweight Japan where the market underappreciates prospects for sustained reasonable growth in the next several years.

We are ready for volatility with additional cash available to hunt bargains as softening economies deliver lower earnings than many in the market expect.

Andrew Doherty. AssureInvest

This article is provided as general information only and should not be construed as personal financial advice. It does not take into account the reader’s objectives, financial situation or needs.

FREE Special Report: How to Jump ahead of competitors and add more value for clients

Learn how you can boost profits while enhancing customer outcomes.