Delta’s rapid propagation is likely to prompt more dramatic restrictions on movement as the northern hemisphere winter approaches, particularly in areas with low vaccine take up. Still, the economic impact will be nowhere near as severe as in the first half of 2020. Public health risks will continue to decline as immunisation rates rise. There is also far greater understanding of other methods to reduce the spread of disease such as mandated mask wearing, testing, tracing, quarantining, social distancing and local rather than broad brush lockdowns.

Economic recovery continues from almost total global shutdown in the first half of last year. The pace of growth is likely to slow after the initial burst, but company earnings are being supported by rising revenue, operating leverage and automation offsetting higher input costs.

Recession risk is low in the near term given improved management of the virus, elevated savings and confidence, supportive monetary and fiscal policy and rising employment, investment and debt. The return to travel and work from the office will contribute to synchronised global growth through 2022.

Services activity should continue to rise in tandem with mobility, though this may be offset by some moderation in goods demand which was pulled forward in the first half of this year. The US economy is a long way from peak, but it is more advanced in its cycle than Europe, Japan or Australia. Inflationary pressures over at least the next two years are unlikely to build up strongly enough such that a dramatic tightening in monetary conditions may stop the recovery in its tracks.

China continues to be a strong contributor to global growth despite its slowing pace as last year’s stimulus measures are unwound. Gross domestic product (GDP) might rebound by an extraordinary 8% in 2021, and by close to 6% in 2022, supported by household consumption, business investment and exports underpinned by improving international demand. Retail sales lifted 12.1% while fixed asset investment rose 12.6% in the year to June 2021. Rising production costs that were crimping business margins are beginning to moderate.

Productive innovation

Boosted productivity should add considerably to growth in the next several years. Crises tend to encourage innovation as individuals and businesses strive to resolve difficulties through reinvention. Digitisation is improving customer service and supply chain efficiencies and supporting more flexible working from home. Energy developments are helping reduce the costs of pollution and power generation. Medical innovations are allowing people to live longer and get back to work faster after injury.

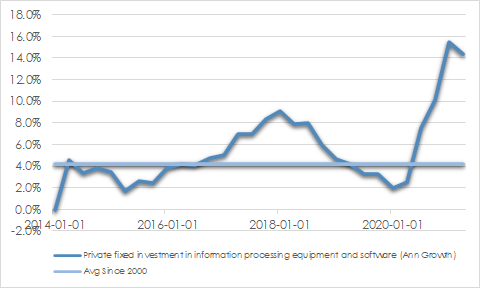

Rather than destroying jobs, technologies being developed are lifting output from each unit of physical and mental effort while constraining inflation somewhat. Investment in information processing equipment and software has been rising significantly in the last year. The 14% lift in the year to April 2021 was more than triple the typical pace.

CHART 1: US INFORMATION PROCESSING EQUIPMENT SPEND

Source: St Louis Fed, AssureInvest

Productivity typically rises after recessions as the smaller workforce in trimmed-down companies still need to cover the same amount of work. Investment allows productivity gains to be more sustained. Working population growth will be inhibited for some time because of aging and reduced migration due to the pandemic, thereby increasing the impetus for technology enhancements.

Central bank policy question

How central banks escape from the period of extremely loose policy is a critical question. The US Federal Reserve wishes to postpone tightening until employment has recovered significantly while Europe and Japan are a long way off achieving inflation goals.

Strong economic growth and rising asset prices will increasingly make monetary settings appear overly loose. Speculative excesses are likely to build in the meantime, increasing the chances that liquidity will need to be withdrawn more dramatically at some point in the future.

Inflation is a risk that may shorten the length of this cycle. However, the recent rise in inflation mainly reflects base effects as existing conditions are compared to pandemic-recessed prior data. The rapid rise in goods demand prompted supply chain troubles like bottlenecks at ports, and in shipping, road and rail networks. Holdups should clear in the next few months as goods demand softens and production rates lift.

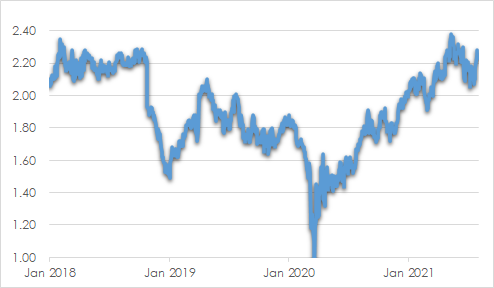

Inflation expectations have moderated after the sharp rise earlier this year but are likely to turn higher again as labour markets tighten and rents begin to rise once more in the next few years. Commodity prices could be well supported given rising demand from the US through the infrastructure push and green energy transition. Onshoring of supply chains particularly in essential items in response to geopolitical risks will reduce global efficiencies and add somewhat to pricing pressure.

CHART 2: US 5-YEAR, 5-YEAR FORWARD INFLATION EXPECTATION RATE

Wages have lifted due to the difficulty in finding skilled labour, but increases are likely to be capped until labour markets tighten over the next two or more years. Large sections of the populace have dropped out of the workforce. Many are retiring. Others will be kept out until health risks sufficiently subside, likely over the next several months.

Investment strategy

Our portfolios are structured to benefit from further economic growth and risk asset appreciation. Corporate earnings should continue to grow strongly and surprise consensus on the upside though higher taxes and inflation poses a threat in some equity sectors.

The gap between cheap and expensive companies is unusually wide which provides opportunities for active managers. As general market prices rise, we press more toward the most outstanding sustainable growth businesses possessing pricing power and rising dividends.

However, we continue to find value in some areas where the market is underappreciating the leverage to the cyclical recovery. These include certain industrial firms and markets such as Europe and Japan which have a higher proportion of cyclical businesses. We also still find compelling investments amongst some companies most encumbered by the pandemic that will gain significantly as the globe increasingly reverts from its current state of fear.

We normally stay away from smaller companies due to their tendency to disappoint but we presently hold modest exposures to US small caps which offer attractive relative value and, as most earnings are derived domestically, exposure to the blistering US economy.

The outlook for real estate will improve as life returns nearer to normal, allowing shopping centre foot traffic to improve and more businesses to return to work in the office. Growth in the proportion of online sales continues to boost demand for industrial property. Low interest rates are supporting valuations and healthy distributions are attracting yield-seeking investors.

Fixed interest assets are likely to be under pressure in in the next few years, so we are under-weight the asset class. It is unlikely that inflation will return to the very sharp pace seen in the 1970s, but even moderately higher inflation erodes expected fixed income returns and should create an environment of higher long term interest rates. Longer term bond yields are likely to rise faster than short term rates, thus we position the fixed income portfolio to have shorter duration than our benchmark.

Credit spreads are much tighter than historic norms due to central bank asset purchases and the global investor hunt for yield, so we are less inclined to add to corporate bond positions now. We far prefer higher quality investment grade credit which will perform better than most in a selloff that may transpire should inflation surprise the market on the upside or the economy shock on the downside.

Andrew Doherty. AssureInvest

Please note a version of this article was first published in SMSF Adviser Magazine.

© 2021 AssureInvest Pty Ltd (ABN 55 636 036 188 AFSL number 478978). No part of this publication may be reproduced or distributed in any form without prior consent in writing from AssureInvest.

The Information constitutes only general advice. In preparing this document, AssureInvest did not take into account your particular goals and objectives, anticipated resources, current situation or attitudes. Before making any investment decisions you should review the product disclosure document of the relevant product and consult a securities adviser. Past performance is no guarantee of future performance. This document is not intended for publication outside of Australia.

FREE Special Report: How to Jump ahead of competitors and add more value for clients

Learn how you can boost profits while enhancing customer outcomes.