Global economies should continue growing beyond the current year, helped by expansive monetary policy and additional fiscal support. Corporate earnings and dividends will benefit. We expect risky assets like shares and property to beat defensive assets like cash and fixed interest over the next several years.

We now have more cautious positioning in our multi-asset portfolios, although we are not overly bearish. Now is the time for investors to have even greater focus on quality and selected diversification. For our direct equity holdings, we are looking for companies with a competitive edge within their respective industries and are seeking opportunities in out-of-favour value stocks.

Elevated valuations in certain segments and the likelihood that various events could unsettle markets during 2020 encourage us to hold higher than usual cash levels so we are ready to snap up bargains as they are offered by the market. Corporate credit is an area of increasing concern, particularly as credit spreads have tightened despite slowing earnings growth and rising debt. If inflation modestly rises as we expect, long bond yields are likely to rise from depressed levels.

An extraordinary economic and political environment shapes the outlook for financial markets. Several critical issues deserve scrutiny, namely sluggish global growth, extreme monetary expansion encouraging excessive investor risk taking, the likely upside surprise of US inflation and numerous geopolitical uncertainties.

Global growth in low gear

Activity is stabilising once more following the growth slump through 2019. Manufacturing activity appears to be improving while steepening yield curves point to rising confidence and the US/China trade truce promises at least a mild recovery in trade. Consumption is assisted by jobs growth and low interest rates but may moderate as employment markets tighten.

Few signs point to a global recession in the near term. Yet it is unlikely that global growth will soon get out of the slow lane. High debt levels, aging populations, technological disruption and climate change each meaningfully obstruct faster growth.

Fiscal policy is supportive in China, Europe and Japan, but there is little impetus for governments to lift spending by the degree required to bring about a sharper upswing. Trade-exposed Germany remains committed to budget balance and debt constraint despite being close to recession with the elevated risk that job losses in the automotive sector could broaden to the wider economy.

China growth slowing but more sustainable

China’s economy is structurally slowing as it transitions away from credit fuelled growth through infrastructure development and support for inefficient state-owned enterprises toward more sustainably expanding consumption and private enterprise. Firming manufacturing data indicate the worst of the impact of US/China trade tensions is passing. The Government has lifted infrastructure investment to further sustain positive momentum.

The coronavirus outbreak will drag first quarter activity. The degree to which it is deadly and contagious is not yet known. The coronavirus will interrupt travel, accommodation and retail sales. Consumption growth had already slowed before the outbreak in tandem with more subdued discretionary income growth, household deleveraging and the hit to confidence from US/China tensions. Authorities will respond rapidly with additional monetary and fiscal support to meet growth targets for the full year. However, the structural shift towards a services-based economy means the response is likely to be slower than in the past. Overall growth this year is likely to be down on 2019.

Extraordinary monetary stimulus encouraging excessive investor risk taking

Asset prices are being distorted by highly accommodative monetary policy including extremely low interest rates and bond purchases by central banks in the US, Europe and Japan.

Only in 2018, the US Federal Reserve and European Central Bank were reducing the size of their balance sheets and the US Federal Reserve was in the middle of raising interest rates toward normalised levels.

In a significant about face, the US Federal Reserve cut rates by 25 basis points three times last year. It also recommenced a bond buying program and guided to low interest rates for an extended period. Central banks in Europe and Australia were prompted to follow this path of renewed accommodation.

The resultant fall in interest rates now sees the value of debt with sub-zero yields, guaranteeing a loss to investors holding to maturity, reach USD 14 trillion internationally. Given

economic conditions have not collapsed, investors have been encouraged to purchase riskier assets like equities and credit. The volume of corporate debt, particularly in the US, has expanded markedly while credit spreads have narrowed. Investors have been enticed toward lower quality credit in search of enhanced yield. Share prices have appreciated despite slower economic growth and only mild earnings expansion.

Investors should be aware of the increased financial vulnerabilities associated with the present extraordinary monetary policy settings. Central banks have less firepower to fight the next downturn. In the meantime, the debt cycle is likely to last longer. Inefficient companies that would not otherwise have access to debt markets are able to survive longer. There are likely to be terrible collapses once interest rates climb once more, especially when coupled with a downturn in demand.

Unappreciated inflation especially in the US

The prospects of gradually rising inflation are seemingly being ignored by investors. The US labour market is tightening as robust jobs growth continues while tougher immigration rules restrict workforce expansion. New tariffs are disrupting supply chains. Technological change and globalisation have suppressed inflation, but this will not last forever. In time, the innovations we have witnessed in the last decade such as in robotics and artificial intelligence will boost productivity and this will add strength to workers’ ability to push for higher wages.

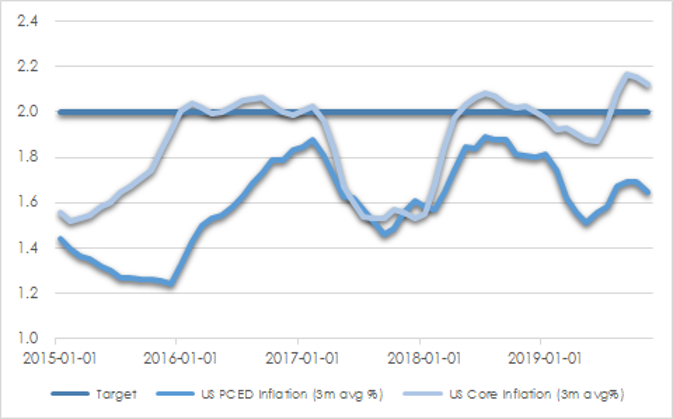

Several measures of US inflation are already above the 2% target, though the US Federal Reserve’s preferred measure now reads 1.6%. Inflation expectations based on financial instrument pricing is merely for inflation to average 1.7% over the next five years. Realised inflation is likely to exceed this, encouraging the yield curve to steepen in time.

CHART 1: US INFLATION

Source: St Louis Fed, AssureInvest

In an election year, the US Federal Reserve will prefer to stay on the side lines. With inflation shifting upwards and unemployment declining toward 3%, the US Federal Reserve is likely to raise rates in early 2021. A rate rise in the second half of this year is not impossible. Interest rate policy is set to prompt market volatility. The market is expecting one 25 basis point cut this year.

Geopolitical risks

Geopolitical power struggles exampled by recent tensions in the Middle East and between the US and China threaten financial market stability.

Trade uncertainty is likely to continue for several years and may even rise after the US election. It is unlikely that trade war would bring about recession, but there are implications for specific companies, industries and the relative competitiveness of various countries. The “phase one” deal helps remove some uncertainty by reducing tariffs on several Chinese goods in exchange for increased purchases by China of US farm, energy and manufactured goods. However key structural disagreements remain such as in relation to intellectual property protections, forced technology transfers, currency management, subsidies for Chinese companies and strategic rivalry.

Britain has now left the European Union but there remains considerable uncertainty about the implications for its own economy. Consumption and investment will benefit as the confounding dilemmas arising from the 2016 Brexit referendum are gradually resolved. Widespread moves of financial sector businesses to mainland Europe do not appear to be occurring. It is most likely that the EU will be constructive rather than punitive in its dealings with the UK and in the establishment of new trading arrangements.

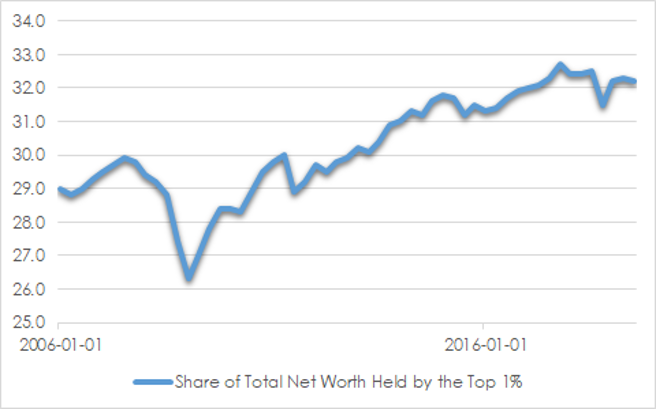

Elections in US this year and Germany next year are likely to influence asset prices. Populism continues to grow internationally as soft economic activity and rising income inequality are fuelling the continued rise in populism as trust declines in mainstream political parties. Several political movements encourage isolationism and downplay the value of global institutions. High inequality fuels support for policies that may slow short term growth such as wealth taxes and increased social security and healthcare funding. The proportion of total US wealth accounted for by the 1% most wealthy individuals is now 32%, up from 29% in 2006.

CHART 2: US WEALTH SHARE

Source: US Federal Reserve Board

It seems most likely the Democrats will maintain control of the US House of Representatives while Republicans maintain control of the Senate. The markets are likely to take a win by the current administration or a centrist Democrat in their stride while victory by a left-leaning Democrat would increase policy uncertainty.

Andrew Doherty. AssureInvest

This article is provided as general information only and should not be construed as personal financial advice.

A version of this article first appeared in SMSF Adviser.

Contact Us

Let us demonstrate how we can deliver outstanding outcomes for you.

p +61 2 8094 8410

e info@assureinvest.com.au

About AssureInvest

AssureInvest is your trusted professional investment partner. We offer a holistic and successful investment approach and carefully tailored solutions for individual needs, as well as cost saving innovations, integrity at the highest level and attentive customer service.

Our advisor clients are empowered to boost their profits and deliver better investment outcomes, benefiting their clients and the broader community.

Our disciplined and long term focus provides a critical framework for assessing new value-adding opportunities, preserving capital, generating superior returns and implementing at low cost.

Copyright

© 2020 AssureInvest Pty Ltd (ABN 55 636 036 188 AFSL number 478978). No part of this publication may be reproduced or distributed in any form without prior consent in writing from AssureInvest.

Disclaimer, General Advice Warning and Disclosure

The data, information and research commentary in this document (“Information”) may be derived from information obtained from other parties which cannot be verified by AssureInvest and therefore is not guaranteed to be complete or accurate, and AssureInvest accepts no liability for errors or omissions.

The Information constitutes only general advice. In preparing this document, AssureInvest did not take into account your particular goals and objectives, anticipated resources, current situation or attitudes. Before making any investment decisions you should review the product disclosure document of the relevant product and consult a securities adviser. Past performance is no guarantee of future performance. This document is not intended for publication outside of Australia.

This document is current until replaced, updated or withdrawn and will be updated if the information in it materially changes. Please refer the AssureInvest Financial Services Guide (FSG) for more information.

This is available at: assureinvest.com.au/wp-content/uploads/2016/05/FSG_AssureInvest_Dec-2015.pdf.

AssureInvest personnel may own securities referred to in this document. They do not receive compensation related to the information or commentary in this document.

FREE Special Report: How to Jump ahead of competitors and add more value for clients

Learn how you can boost profits while enhancing customer outcomes.