Remarkable cross currents are creating turbulence in global economies. The rewiring of international trade relationships and corporate supply chains increases uncertainties and creates opportunities for investors.

Global activity is slowing but still maintaining a decent pace. Purchase managers indices reflect stronger services than manufacturing activity. Tight labour markets and easier policy settings are supporting consumer spending. These forces are helping to offset the costs of necessary rewiring of global supply chains in the face of trade and geopolitical tensions.

Changed US tariffs and trade policy are proving less brutal than expected. However, the full impact has not been felt and tariff rates are yet to be settled in several countries. US importers have passed on little of the impost so far but are likely to do more so in time.

Fiscal tailwinds are proving more decisive than trade friction. Rude health of American corporates is reflected in the strong third quarter earnings season where the vast majority beat consensus expectations.

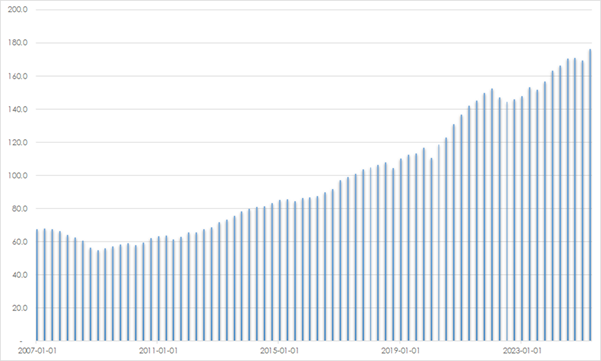

A positive feedback loop exists in the US economy where consumption is increasingly linked to stock and property markets. Spending by the top 10% of US earners accounts for nearly half of the total. Household net worth has increased to USD 167 trillion from USD 67 trillion in 2007 before the global financial crisis. Meaningful asset price falls could have an inordinate impact on spending.

CHART 1: NET WORTH: US HOUSEHOLDS AND NON-PROFIT ORGANISATIONS USD TRILL

Source: St Louis Fed

The going is much tougher for lower-income families, the extremes of which have shown in recent well publicised debt defaults and warnings from JP Morgan chief executive Jamie Dimon that “when you see one cockroach, there are probably more”.

AI investment boom to boost productivity but timing and scale of gains uncertain

The artificial intelligence investment boom is contributing to activity especially in the US and China. The big four “hyperscalers” are substantially increasing investment budgets in AI and cloud infrastructure. The resulting decline in free cash flow increases the pressure to generate strong returns on these investments. In the meantime, the platform is there for growth in demand for data centres, semiconductors and energy infrastructure.

Productivity is likely to be extended across economies in time despite risks of insufficient power supply and likely wastage of some of the current financing. AI is likely to be adopted more rapidly than previous redefining technologies given the global scale and competitive nature of key developers and the relative ease of access of its applications. Job demand is likely to be increasingly impacted by replacement of roles involving repetitive routines while creating new roles requiring advanced skills. Large firms with capacity to invest in AI will have reduced headcount needs. Wealth inequality challenges could be aggravated. Unemployment for youths 16-25 years is rising. Producers of AI technologies have been central to equity market gains in the last year. However, it is the adopters of these new technologies that are likely to benefit most from productivity gains in coming years.

Economic gains from AI investment are likely, but there is high uncertainty over the timing and quantum of these. For now, demand for AI infrastructure appears to be running well ahead of supply, and this reduces the chances of wasted capacity. A pullback in capex and share prices would be likely if investors become disillusioned with the potential for returns. The resulting fall in capex would drag economic growth, but probably not catastrophically, especially as most AI capex has been funded from hyperscalers out of growing free cash flows. The hit to household wealth from a selloff in large capitalisation technology stocks would likely be a more meaningful drag on consumption especially among higher income households, particularly given their high concentration in main equity indices. At least a mild uptick in unemployment would result.

Bias to monetary easing continues

Inflation continues to moderate from post-pandemic highs. Labour markets are easing modestly while remaining reasonably tight. US inflation is higher than elsewhere and is likely to remain so for several years given the fiscal impulse and monetary easing. Tariff costs have added modestly to goods prices, but more will likely be added in the next few months. China’s low inflation through excess supply is likely to remain problematic internally but this should help inflation decline to 2% targets in economies outside of the US as Chinese products are redirected from the US.

The easing bias in monetary policy is likely to be maintained through 2026 given relatively subdued inflation. However, price increases structurally higher than before the pandemic mean that cash rates will also remain higher. Capacity is there to cut rates should tariff imposts weigh more dramatically than expected. Despite US inflation running ahead of target levels, concerns over softening labour markets will encourage the US Federal Reserve to ease at least by another 50 basis points by early 2026. Constraints to labour supply in response to tighter US immigration policy and job dislocation as a result of AI-take-up complicate the outlook. The subdued outlook for smaller company capital spending and weak housing activity will be concerns. US fiscal stimulus supports activity, and inflation is likely to stubbornly exceed target levels unless AI-linked productivity accelerates.

The Reserve Bank of Australia is likely to stall any further rate cuts from the current 3.6% for several months given the recent rise in prices. However, with inflation in the target 2-3% band and Australia’s open economy’s exposure to external risks, one more rate cut this cycle is likely to be justified in the early part of 2026.

Credit quality under question

Credit quality has been in the news following the collapse of US car parts supplier First Brands and subprime car financier Tricolor. Both entities heavily borrowed from nonbank financial institutions such as private credit providers. A diversified financial system has benefits. Failures like these could have encouraged a run on bank deposits had lenders been banks alone. However general risks are now more difficult to track. Vigilance is wise, especially as default rates for high-yield bonds are around long-term averages despite relatively tight credit spreads. Meanwhile, as the International Monetary Fund warns, the increased participation of inexperienced retail investors in the private credit sector raises the spectre of excessive risk-taking and system interconnectedness.

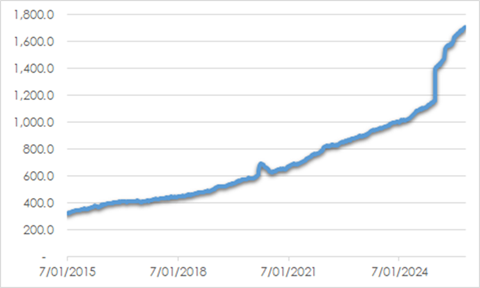

US private credit assets have grown sharply in the last decade as tighter post-global financial crisis regulations restricted bank lending. Banks have increased loans to nonbank financial institutions, reflecting the growing interconnectedness in global finance, however these are still a modest 10.4% of total bank loans according to Moody’s, from 3.6% a decade ago. Loans to private credit funds can be attractive to banks as lower capital requirements mean returns on equity are often higher than traditional commercial loans. The inherent lower transparency of indirect lending highlights the importance of enhanced credit risk management as private credit assets rise.

CHART 2: US BANK LOANS TO NONDEPOSITORY FINANCIAL INSTITUTIONS (USD BN)

Source: St Louis Fed

Investment strategy

Positive investor sentiment is supported by fundamentals given strong US earnings growth and large capital investments in technology largely covered by strong cashflows. There is little evidence of end of cycle being close, such as aggressive Federal Reserve tightening, recession or corporate excess such as large numbers of mergers and acquisitions.

However, high valuation multiples are likely to cap gains. Investors should prepare for turbulence. Modest misses relative to consensus expectations could prompt sharp reactions. Concentration risk is high as mega capitalisation technology stocks have dominated returns.

Diversification away from expensive areas is critically important. Diversification means that there will always be portions of the portfolio that lag, and underperformance may occur in strong or speculation-driven markets. Not being in the hottest stocks may not feel good in the short term but, when conditions eventually turn, holding lower valued but still high-quality businesses will produce better results. To help preserve capital and grow wealth more assuredly, valuation should not be ignored, nor should the willingness to dial up or down portfolio risks relevant to the opportunities presented.

Massive investment in artificial intelligence infrastructure is probably the beginning of a transformational period for the world economy. Many companies will achieve profitability enhancements as implementations are made. However, there is already a great deal of excitement priced particularly into US stocks, while uncertainty exists over the quantum and timing of productivity gains, the bulk of which may take several years.

We hold broadly neutral equity allocations overall given the supportive fundamental environment. With valuations becoming increasingly problematic and markets largely ignoring lurking risks, we allow cash levels to gradually build and continue the upward shift in quality across the portfolio.

FREE Special Report: How to Jump ahead of competitors and add more value for clients

Learn how you can boost profits while enhancing customer outcomes.