Resilient economic expansion is supported by reasonably strong employment conditions, softer inflation and lower interest rates. Services activity remains robust while manufacturing appears to be strengthening from weakness in the last two years. The impact of US tariffs has been relatively mild, offset by artificial intelligence infrastructure spend and easier credit conditions. However, the consumption drag will continue as more of the cost is passed on via higher prices.

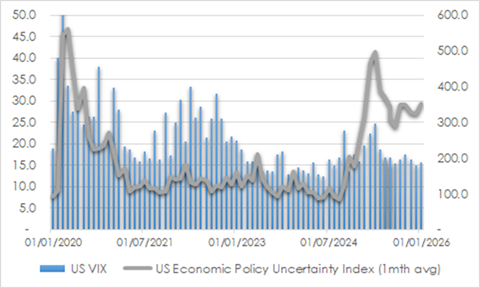

United States activity will more evidently slow in the first half of this year as a weaker jobs market weighs on consumption, but tax cuts and AI-related investment should see reacceleration later in the year. Lower interest rates will also assist growth, but only mildly so given the high proportion of fixed rate debt. Trade policy uncertainty has spiked again recently but remains well below the heights after “Liberation Day” in April 2025. Activity will benefit as more trade deals are finalised.

CHART 1: US POLICY UNCERTAINTY VS VIX

Source: St Louis Fed, CBOE

Elsewhere, Chinese growth is helped by robust exports and manufacture offset by weak consumption and property. Policy support remains incremental. European momentum is lifting despite tariff headwinds as consumption is supported by fiscal expansion, significantly lower interest rates, high household savings and rising real wages. Australian activity should continue to improve through income gains, supportive government policies, moderating inflation and strengthening housing and business investment.

Monetary policy more supportive

Given weakness in the labour market, the US Federal Reserve is likely to justify at least 50 basis points in further rate cuts in the next several months despite inflation running above target in the first half of the year.

Pressure from Trump for lower US interest rates includes via appointing the chair of the Council of Economic Advisers Stephen Miran to the Federal Open Market Committee, attempts to terminate Governor Cook and the selection of a new Fed chair once Powell’s term expires in May. However, concerns that Fed decisions will be overly politically influenced are reduced by the reactions in long term bond yields that would shift painfully higher if investors felt rate cuts were unacceptable. In any case, it is unlikely that committee members would be willing to force decisions that would be marked in history as economically damaging.

The Eurozone cash rate has been reduced to 2.0% from 4.5% late in 2023. There is the possibility of further cuts of 50 basis points this year should inflation soften much more. It is more likely that there will be no change in rates for an extended period however. By contrast, Bank of Japan’s key policy rate should be lifted to 1.0% by the end of this year as spending and investment growth support sustained gains in overall pricing levels. As real interest rates will be negative at these levels, monetary policy will still be accommodative. A rate of 1.5% should be reached by the end of 2027.

KEY INVESTMWENT THEMES

Global conditions are being impacted by several fundamental themes involving geopolitics, innovation and the credit cycle.

Fragmented world trade – International trade is being upset by trade tensions particularly US-China while significantly involving Europe and other key parts of the world as well. Uncertainties have declined since April 2025 “Liberation Day” though US tariff levels remain substantially higher than they were a year ago. Stresses over Greenland probably encourage European defence spending given the need for greater security independence already spurred by Russia’s invasion of Ukraine. A one-year trade truce between US and China completes in November 2026 at which point tensions could rise once more. Global trade endures but global integration is partially unwinding. Growth prospects are reduced as trading nations face increased barriers requiring urgent and complicated adjustment.

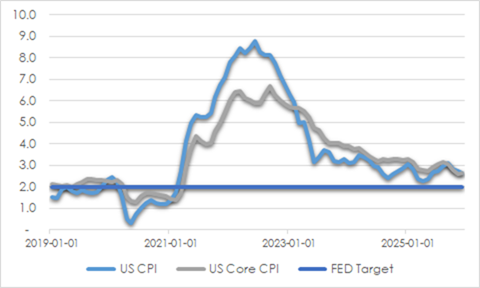

Inflation – Challenges relating to excessive inflation since 2022 are easing. US price escalation is likely to decline toward targeted levels by the end of the year as the jobs market cools, rental vacancies rise and house prices stagnate. Trump will be keen not to enact policy that may lift prices and aggravate cost-of-living challenges ahead of mid-term elections in November. European inflation may even fall below desired levels this year as wage growth cools, the euro lifts and China diverts lower cost exports.

CHART 2: US INFLATION

Source: St Louis Fed

Fiscal and debt expansion – fiscal ill-discipline and enormous sovereign debt burdens threaten higher inflation, taxes and interest rates in time. The market is likely to suffer bouts of anxiety over debt sustainability. This was recently exampled in the sharp lift in Japanese long-term interest rates as new prime minister Takaichi plans to increase fiscal spending including pausing a sales tax on food and beverages without compensating revenue measures. The US faces rising interest costs and political challenges in reducing budget deficits. Any indication that the US Federal Reserve is unduly politically influenced could add to upward pressure on longer term yields and downward pressure on the US dollar. Germany is lifting spending while French political instability makes it more difficult to tackle high indebtedness. China is enacting various measures to support the economy in the face of continuing deflationary risks.

AI productivity wonder – Artificial intelligence adoption is likely to drive extraordinary productivity gains across most industries but at a slower pace than many expect. Benefits include enhanced analysis, predictive modelling, autonomous task handling, personalisation and manufacturing efficiency. Businesses likely to gain most include those with greater employee costs with data intensive and repetitive tasks such as in finance, healthcare, manufacture, retail and logistics. However, caution is required as the timing and materiality of take-up is difficult to judge. AI technology producers like OpenAI must produce revenue sufficient to entice the external funding needed for the huge capital expenditures planned. Opportunities include monetised services like advertising, business services and product purchase applications. The AI infrastructure buildout is leading to a surge in demand for hardware, software, power and cooling equipment that will eventually test capacity limits. Market valuations have high uncertainty but most of the mega cap technology providers have strong balance sheets and cash flows, though some participants have begun using debt which if allowed to grow would increase the pressure to perform. Capital spending has not reached a proportion of the economy where a collapse would be a meaningful drag.

Credit cycle – Higher wealth households contribute an increasing proportion of total consumption, correlated with equity market gains. Less wealthy consumers are more restrained given cost of living challenges. Isolated failures in US private credit and subprime have caused concern but the credit cycle is likely to be prolonged by lower interest rates and upcoming US bank deregulation which should encourage lending while corporate earnings should strengthen with the economy, reinforcing interest cover ratios.

INVESTMENT STRATEGY

The high frequency of sensational headlines encourages a focus on fundamentals over noise. High valuations and concentrations in key equity indices mean expected returns are likely to be lower than usual over the forecast horizon. Investors will benefit by shifting portfolios toward increased yield generation and moderated risk with a sharpened eye on valuation.

Further US rate cuts, supportive fiscal policy, reduced policy uncertainty and an immense fixed asset boom should back decent global economic growth and support risk assets like equities, property and credit while keeping longer term bond yields in a limited range. Equity performance is broadening out beyond artificial intelligence capex to areas leveraged to improving economies.

Increased diversification across regions and sectors makes sense but we argue against the temptation to “diworsify” portfolios, a term coined by legendary investor Peter Lynch in his 1989 book “One Up on Wall Street” referring to the detrimental practice of adding too many, often sub-par or unnecessary investments.

Volatility is likely to be relatively high as optimistic scenarios priced into stocks leave little room for economic or earnings disappointments. Entry points will be available for patient buy and hold investors.

We add to the robustness of returns through modest allocations to resources companies that help offset inflation risks and value companies that are more levered to improving economies. However, our overarching preference is for high quality which lifts portfolio resilience through the benefits of compounding as profits are reinvested at high rates of return, greater ability to withstand challenging economic periods and more predictable earnings reducing the chance of large misses against expectations.

In a world where so many investment options appear expensive, opportunities to buy high-quality businesses at discounted prices are surprisingly plentiful after an extended period of investors chasing higher risk areas like commodities and unprofitable tech.

While valuation is stretched at the index level, internally the market displays remarkable valuation discrepancy. Extraordinary opportunities exist particularly in healthcare, materials, financials and industrials segments that have not kept up with some of the more bullish or even speculative pricing in other areas. Several of our portfolio stocks trade on elevated free cash flow yields, reflecting high efficiency of turning profits into cash and strong capacity for dividends, buybacks and debt reduction.

FREE Special Report: How to Jump ahead of competitors and add more value for clients

Learn how you can boost profits while enhancing customer outcomes.