Global growth is likely to slow considerably in the second half of 2025. Heightened geopolitical tensions, tariffs and policy uncertainty is dragging sentiment, investment and hiring plans.

Consumption in the US will be weighed by the lagged impact of tighter monetary policy and drain on real wages from tariff-lifted goods prices and fewer job opportunities. In Europe, weak consumer sentiment is encouraging a rise in household savings.

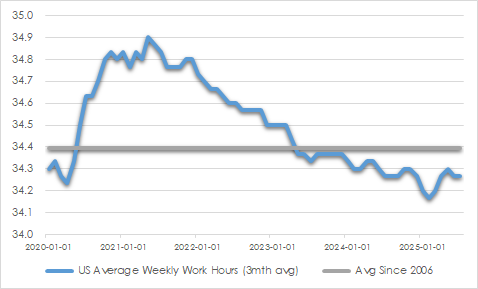

The sharp deterioration in the US workforce is reflected in weak July jobs numbers, downward revisions to prior months’ and lower than average weekly hours worked. Businesses are holding back on workforce changes while policy uncertainty is so high. There is increased risk of a shallow near-term recession, but a more likely scenario is for activity to be soft rather than contracting.

CHART 1: US HOURS WORKED

Source: St Lousi Fed, AssureInvest

Beyond this year, growth prospects are decidedly improving despite trade frictions. Moderating inflation supports a shift toward accommodative monetary policy for the first time in several years. Knowledge that tariffs are inflationary in the short term but deflationary in the longer term will keep US central bankers from raising rates despite likely one-time price increases in coming months. Geopolitical tensions are easing as US trade announcements with China, Europe and Japan hint at less disruptive arrangements and reduced uncertainty. Unemployment should stay relatively low.

Discretionary spending should rise next year as policy uncertainty subsides and incomes rise faster than cost of living expenses. US tax cuts on higher income earners, along with deregulation, should support investment and corporate earnings while adding to government debt and inflation. Productivity gains are likely as technological advances in artificial intelligence, digitisation and robotics are implemented. Skills shortages around the world are likely to be resolved by implementation of various technologies. Small business creation will continue, and well-managed companies will adapt to new trade policy settings.

Fiscal stimulus increasingly consumed by rising debt costs

Government policy is becoming far more interventionist following the primacy of supportive monetary policy for much of the period since the global financial crisis. Governments are juggling increased spending demands on defence and other areas, trade uncertainty and higher debt costs.

The passing of the One Big Beautiful Tax Act contains several pro-growth measures including cost-recoveries that should make it more attractive to build businesses in the US. The Act extends the 2017 tax cuts that were due to expire at the end of the year which would have put vast downward pressure on the US economy. The likely resulting increase in government debt over the forecast horizon reduces the positive impetus from budget deficits. Rising interest costs are taking a greater proportion of total outlays at a time when less productive areas like healthcare, social security and defence are increasingly burdensome.

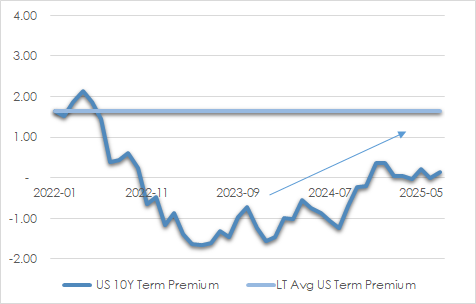

Chaotic and expansionary fiscal policy is likely to encourage an increase in term premia (the difference between long term and short-term yields) for US debt after several years at low levels. However, America’s ability to borrow internationally remains unquestioned, particularly given key economic strengths like scale and diversity, technological prowess, flexible labour market and deep capital markets.

CHART 2: US TERM PREMIUM

Source: St Louis Fed, AssureInvest

Tariffs reward some industries while punishing others

The world is facing US tariffs around 15% on average, the steepest since the 1930s. Though the numbers are by no means finalised, this is a significant demand shock. A pullback in US goods spending and further softness in services can be expected in coming months. However, the decline in policy uncertainty as new arrangements are announced is itself allowing companies to get on with minimising impacts by adjusting supply chains and marketing plans.

Tariffs are a tax that adds to imported product costs which reduces the funds consumers have for other purchases. Some foreign exporters or import wholesalers will absorb the higher costs to maintain volumes. Others will pass the costs on to consumers through higher prices. The more that importers and exporters absorb the costs, the greater the drag on margins and therefore hiring plans.

Tariffs may help make supply chains more secure through onshoring and generate additional government revenue. However, consumers lose out in time because of the shift away from free market dynamics that would encourage countries to produce more of the goods they can make at the best quality and price. Distortions where some industries are favoured over others tend to drag activity from optimal levels.

Inflation lifted in US, weighed elsewhere

Inflation readings are diverging between the US and the rest of the world. Tariffs are pushing up US prices, as seen in the rise in June CPI. Most of these will be a one-off shift. Reorganising global supply chains may also add to costs for a short time. In contrast, tariffs are a demand shock for exporters to the US which will weigh on jobs and prices.

US companies have the capacity to absorb much of the tariffs given the strong profitability gains helped by sizeable price rises since the pandemic. There is a limit to the quantum of price increases that consumers will accept at once but it is likely that much will be passed on in time. Offsetting this will be softening services inflation which has been stubbornly high for an extended period. Softening jobs and rental markets are allowing pressures to ease.

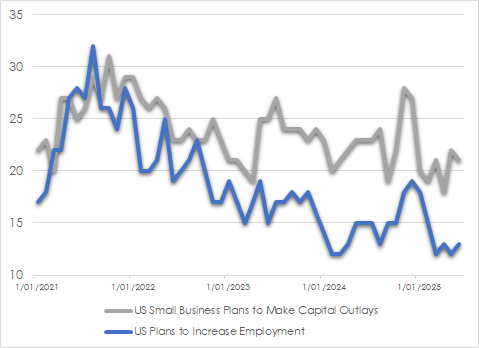

The US Federal Reserve has preferred to wait and see the impact of tariffs before altering short term rates. The quantum and timing of policy changes have been constantly changing and the range of possible outcomes on growth and inflation is extensive. Soft July employment data and small business hiring intentions should encourage a shift towards accommodation from the next meeting in September.

Arguments that tariffs prompt a one-time price rise rather than more persistent inflation should win out by that time. A further weakening in conditions should encourage at least 50 basis points in cuts by the end of the year and at least 100 basis points worth in total by the middle of next year.

CHART 3: US SMALL BUSINESS PLANS

Source: NFIB

Dealing with softer growth and inflation dynamics and potential US tariff demand shocks, the European Central Bank has cut policy rates more substantially, by 200 basis points to 2.0% since early 2024. Additional cuts worth 50 basis points are likely by the end of this year.

Investment strategy

Positive risk-asset returns after inflation are likely over the forecast horizon. However, these are likely to be below historic norms given high equity valuation multiples, tight credit spreads, softer economic growth and inflation back toward targeted levels.

Volatility can be expected to be high, particularly given downside risks including the lagged effects of higher interest rates and possibility of rebounding inflation. Meaningful selloffs would not surprise in the second half. With high expectations built into share prices, disappointments will be treated harshly by impatient investors. Alternatively, signs that tariffs will be substantially reduced or that geopolitical tensions significantly reduce would be welcomed by investors. Signs of speculative manias in several areas of the market increase the necessity for caution.

We are neutral on equities with additional cash on hand to initiate positions at better prices as sell-offs provide opportunities. US equities remains the most clearly stretched key global market, so we are underweight in favour of underpriced European equities which are gaining investor attention on lower interest rates and signs of more proactive fiscal action.

Our focus remains on high-quality but we are diversifying through attractively-priced cyclical businesses. Greater uncertainties and valuations encourage a heightened focus on higher distribution markets like Europe and Australia. Bonds remain stretched, with longer term yields largely rangebound, so we remain underweight fixed interest assets in favour of cash.

FREE Special Report: How to Jump ahead of competitors and add more value for clients

Learn how you can boost profits while enhancing customer outcomes.